does wyoming charge sales tax on labor

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of. 11 - What is the 2022 Wyoming Sales Tax Rate.

In Cheyenne for example the county tax rate is 1 for Laramie County.

. If you do not file your sales tax return within 30 days of the due date of your. Wyoming has a use tax that works in conjunction with the sales tax. Groceries and prescription drugs are exempt from the Indiana sales tax.

As a business owner selling taxable goods or services you act as an agent of the. The state-wide sales tax in Wyoming is 4. Under Floridas sales and use tax if no parts were used in the service and the charge was for labor only then there would be no tax to pay.

Conduct educational seminars throughout the year. Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area.

We advise you to check out the Wyoming Department of Revenue Tax. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs. Provide bulletins publications and other educational material to address.

Wyoming has a 4 state sales tax with counties adding up to an additional 3 resulting in a maximum rate of 7. All labor on both tangible and. The use tax rate is not a consumer tax it is a tax that a business pays for storing or.

Draft formal revenue rulings upon vendor and taxpayer request. Is there sales tax on home improvements in NY. There are additional levels of sales tax at local jurisdictions too.

Labor and material charges. Services that result in a. The state sales tax rate in Wyoming is 4.

But if any parts were used in the. Business filers pay one or the other. We advise you to check out the Wyoming.

The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. This page discusses various sales tax exemptions in Wyoming. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale. No you do not pay sales tax on labor. Wyoming has a destination-based sales tax system so you have to pay.

Does Wyoming charge sales tax on labor. Section 5415b2 of the Sales and Use Tax Regulations provides. 400 2022 Wyoming state sales tax Exact tax amount may vary for different items The Wyoming state sales tax rate is 4 and the average.

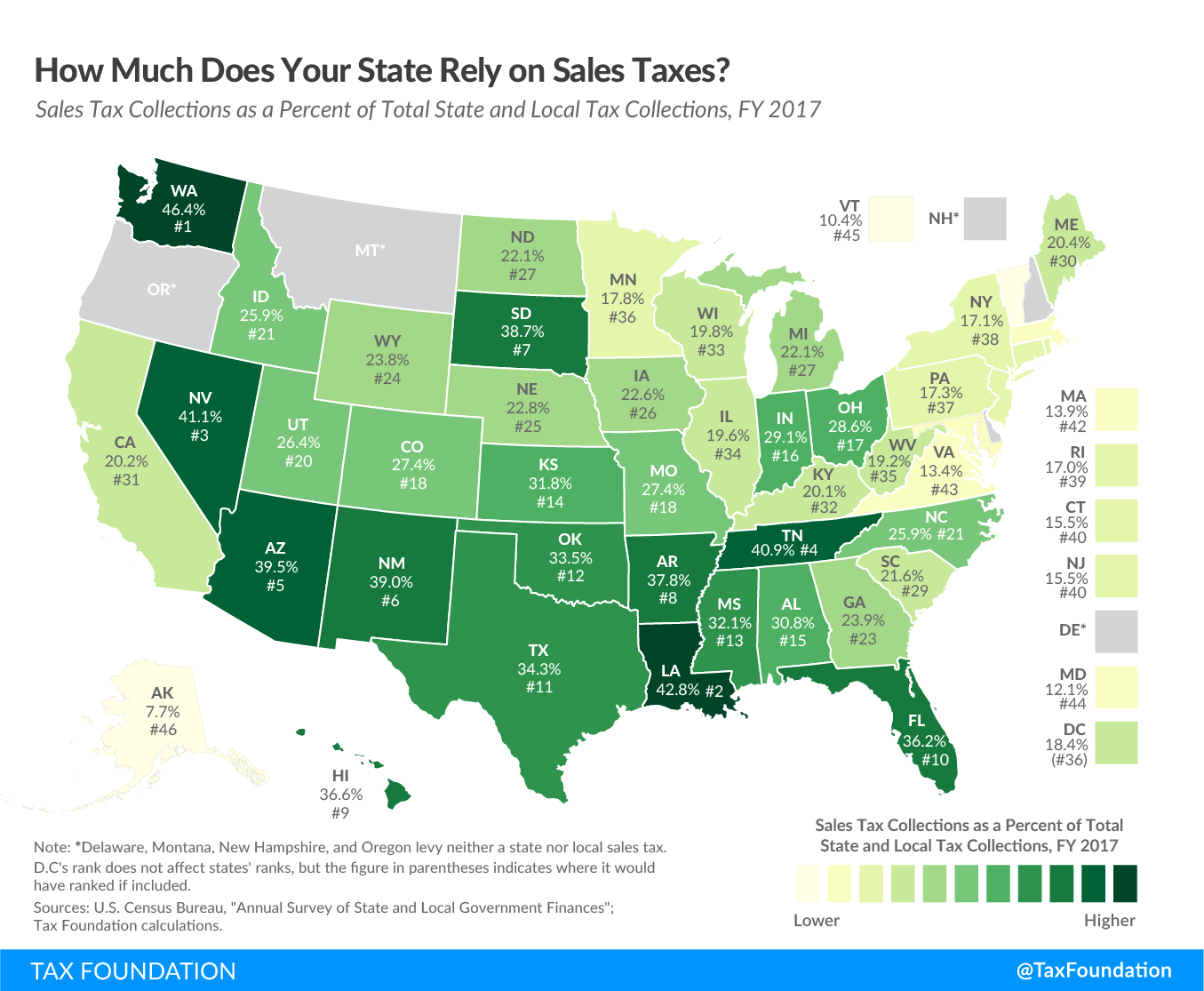

A State By State Analysis Of Service Taxability

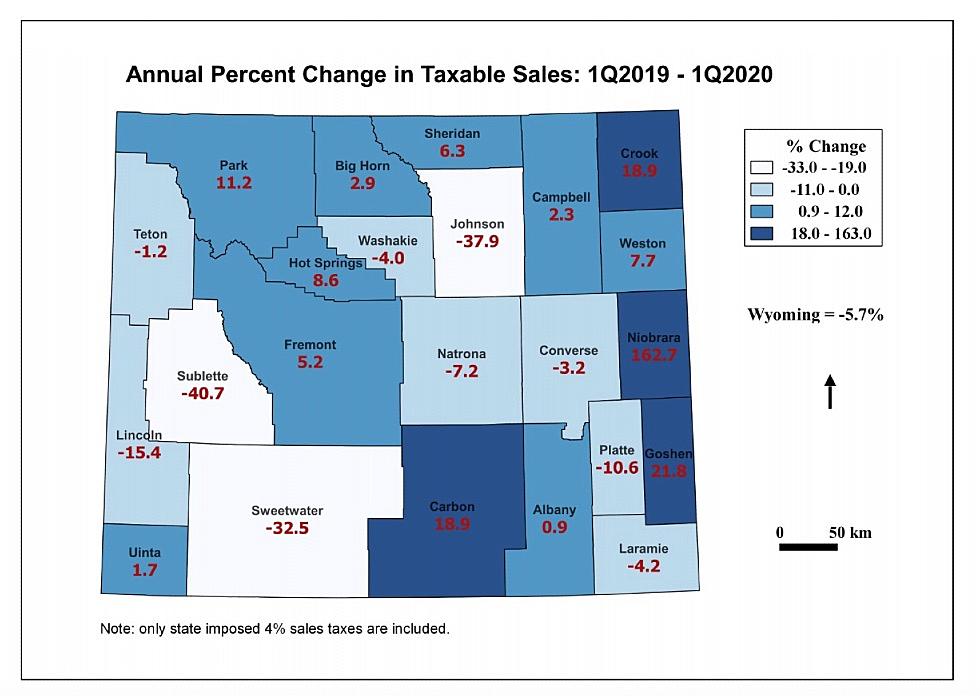

Wyoming S Economy Labor Market Were Declining Before Covid Hit Housing Strengthens

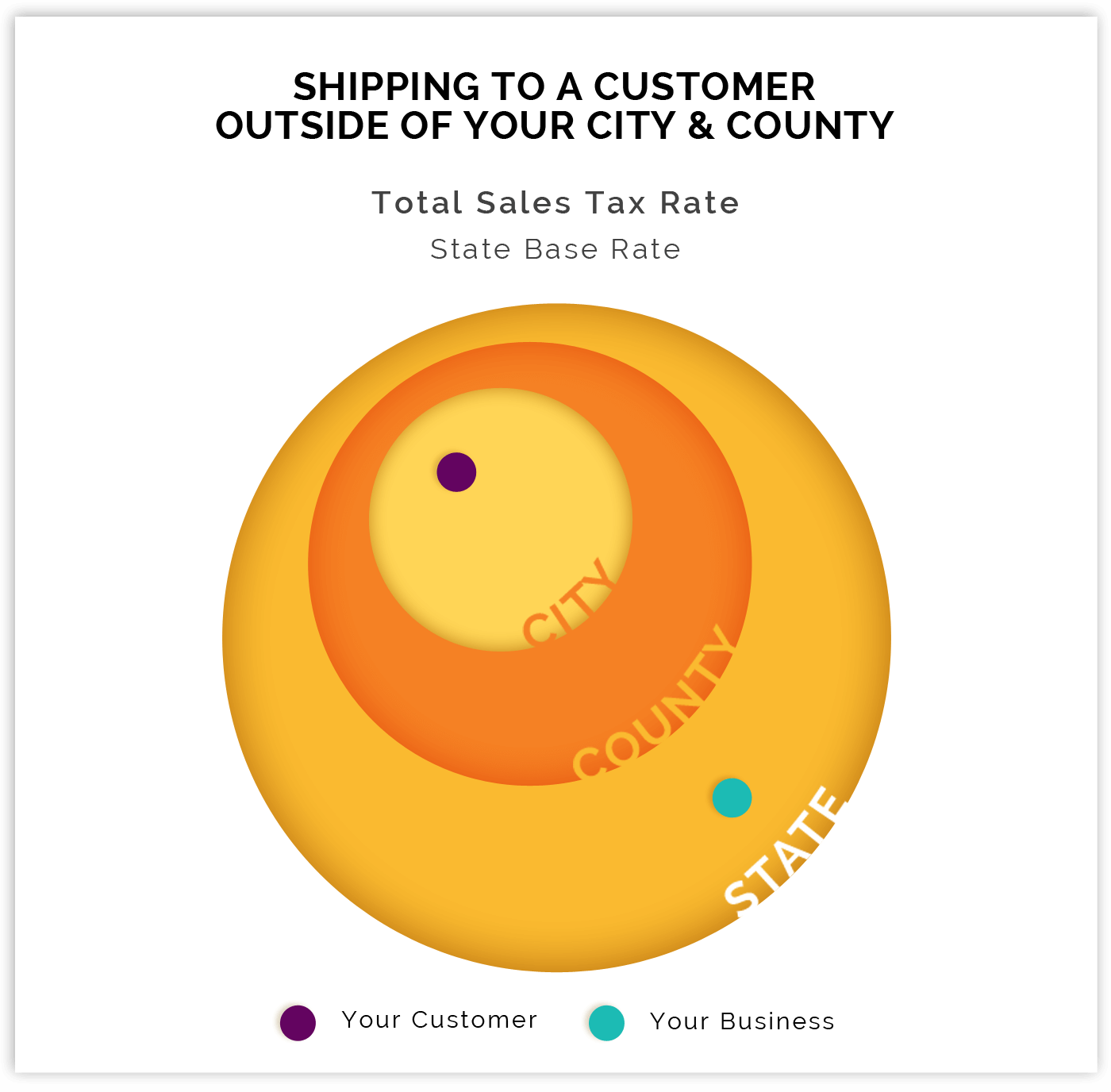

Arizona Sales Tax Small Business Guide Truic

State Gross Receipts Tax Rates 2021 Tax Foundation

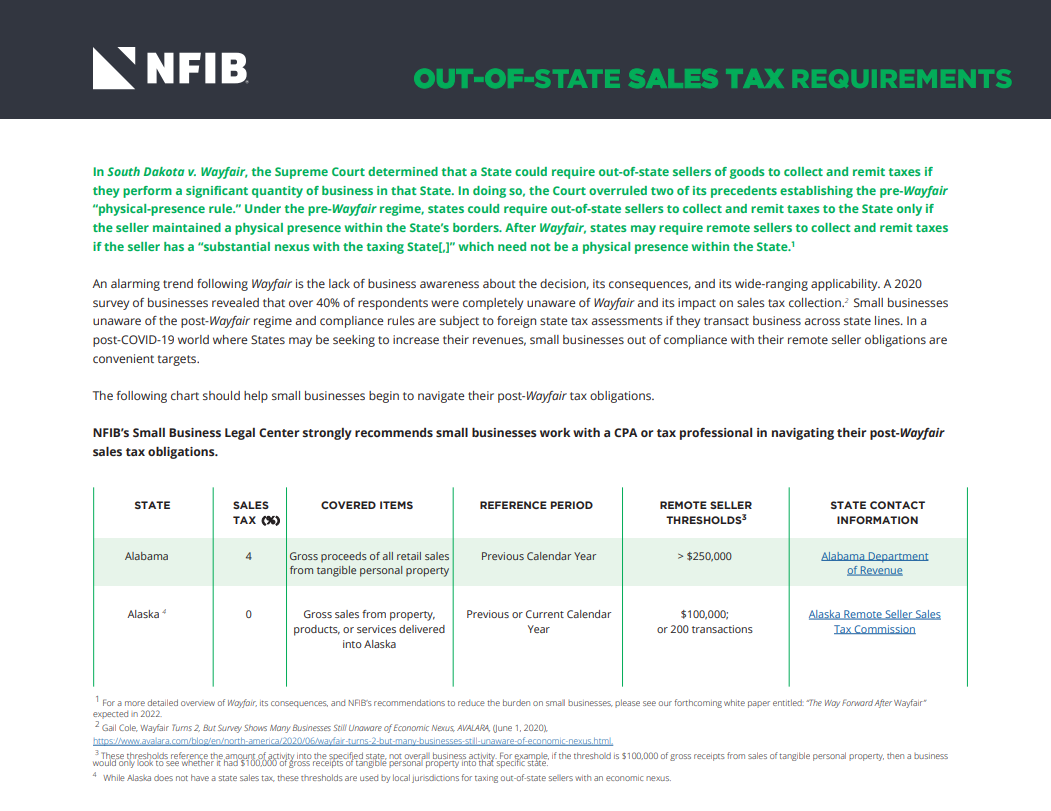

Tax Prep Overview Out Of State Sales Tax For Small Business

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Taxes In The United States Wikipedia

Wyoming Sales Tax Rate Rates Calculator Avalara

Wyoming Sales Tax Handbook 2022

Wyoming Changes Sales Tax Rules For Remote Sellers

State And Local Sales Tax Rates Midyear 2022

Which States Have The Lowest Tax Rates Seniorliving Org

Lawmakers Vote Down Two Wyoming Bills Increasing Taxes On Renewable Energy

Does Rhode Island Charge Sales Tax On Labor

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)